India is reportedly considering withdrawing its recent $4 billion tax demand from Infosys following significant backlash from the IT industry and intense lobbying by the company. The tax dispute centers around a Goods and Services Tax (GST) claim on Infosys’s overseas operations dating back to 2017.

Last month, Indian tax authorities issued a notice to Infosys, insisting that the company’s international offices should be subject to GST. However, recent developments suggest that the finance ministry is reassessing this decision. According to government sources familiar with the matter, the ministry now believes that the demand contradicts India’s broader tax policy, which generally exempts export services from such taxes.

The sources, who requested anonymity due to the sensitivity of the issue, indicated that a formal decision on retracting the demand is expected after the GST Council, led by the federal finance minister and comprised of state finance ministers, meets on September 9.

MUST READ: Kolkata Rape-Murder Accused Sanjay Roy’s Psychoanalytic Profiling Reveals Perverse Tendencies

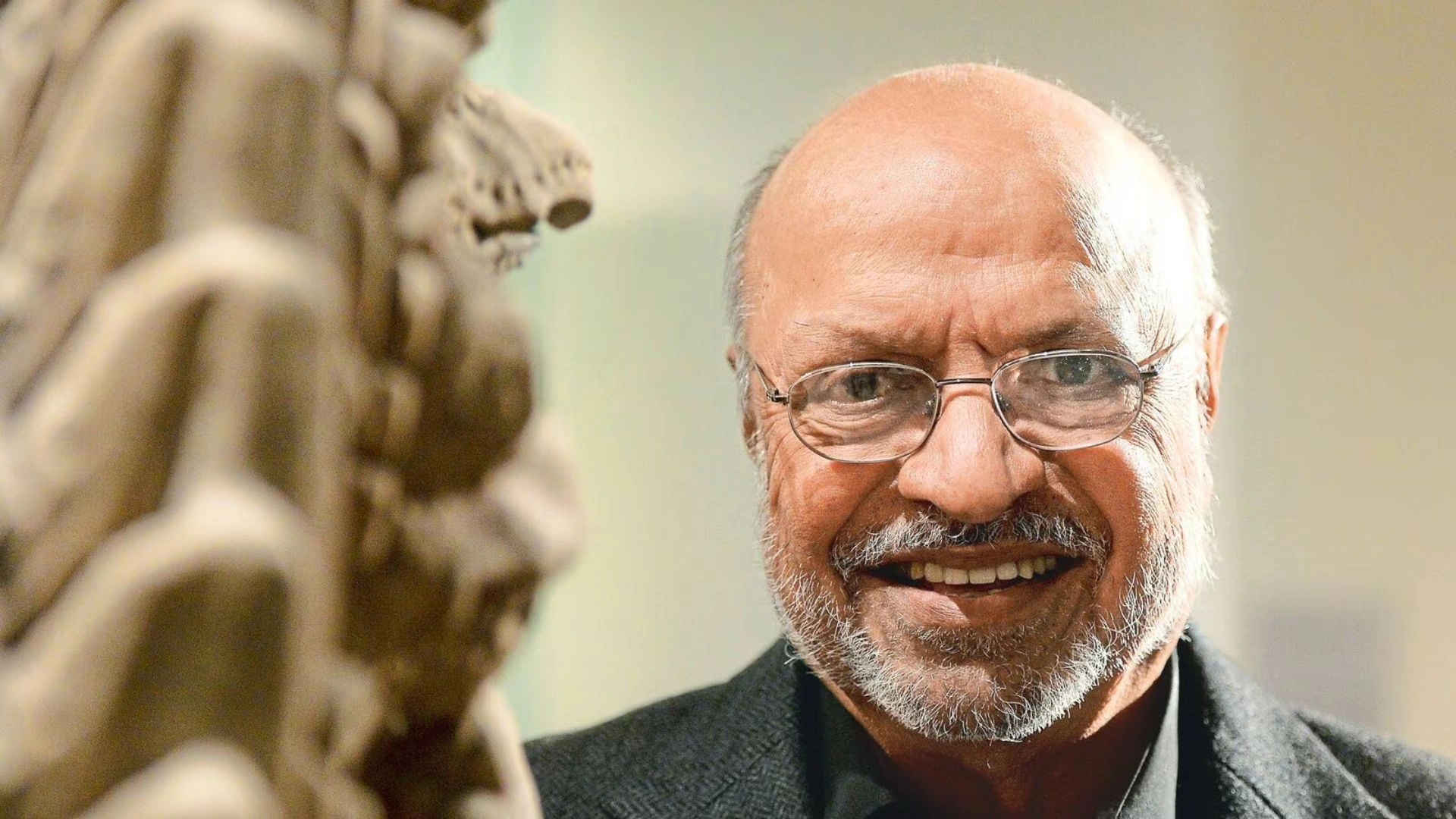

Infosys’s former board member and ex-CFO, Mohandas Pai, has criticized the tax notice as “outrageous” and an example of “tax terrorism.” In response, Infosys’s executive vice president for finance, Sunil Kumar Dhareshwar, recently met with top government officials to argue that the tax claim is unjustified.

Additionally, the National Association of Software and Service Companies (NASSCOM), an industry lobby group, has urged the government to intervene, citing concerns that such notices could undermine confidence in India’s business environment and reflect a misunderstanding of the industry’s operational model.

The Indian government has been known to revise controversial decisions in response to public and industry feedback. Recent examples include the relaxation of a new property tax and adjustments to hiring practices for senior government roles.

The Finance Ministry and Infosys have yet to comment on the matter.