Supreme Court of India has set May 15 (Monday) as the date for hearing the Securities and Exchange Board of India’s (SEBI) petition requesting an extension of the time for finishing the investigation in the report by US short-seller Hindenburg Research by six months, the top court decided on Friday.

The matter was adjourned till May 15 by a bench chaired by Chief Justice of India (CJI) DY Chadrachud and including Justices PS Narsimha and JB Pardiwala. In the meantime, the court stated verbally that they would extend the time for the investigation to SEBI, but not for six months, and that they can extend the period for the investigation by three months.

Tushar Mehta, Solicitor General, pressed on an extension, pointing out the involvement of bank statements from numerous local and international banks. Vishal Tiwari, the petitioner, has objected to the SEBI’s request for an extension of time.

SEBI argued in a Supreme Court motion that, given the aforementioned circumstances, it would require more time to get verified findings and end the probe.

SEBI also stated in the application that determining any violations would take at least 15 months to complete, but that it is making all reasonable efforts to complete the probe within six months.

Supreme Court had instructed regulatory authority SEBI to investigate violations

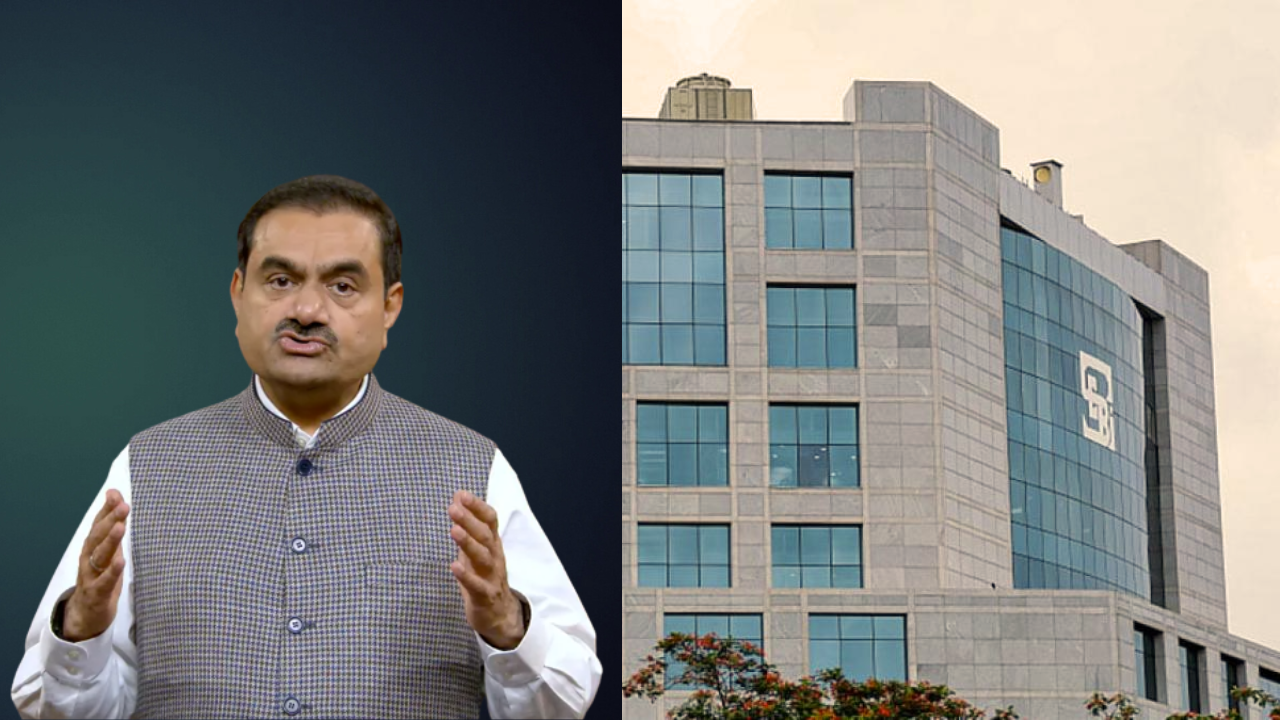

On March 2, the Supreme Court instructed the capital market regulator SEBI to investigate any possible breaches of securities legislation by the Adani Group in the aftermath of the Hindenburg report, which resulted in a catastrophic wipeout of the Adani Group’s stocks worth more than USD140 billion.

The Supreme Court, on the same date, established an expert committee to investigate the matter raised by the Hindenburg Research study on Adani Group enterprises. The committee will be composed of six members, led by former Supreme Court Justice AM Sapre.

The Supreme Court then ordered SEBI to submit a status report within two months. Later the top court then reviewed petitions related to the Hindenburg report, including the formation of a committee relating to regulatory instruments to protect the rights of investors.

Following the Hindenburg report, investors’ wealth was lost in the securities market due to a sharp drop in the share price of the Adani Group of companies.

The conglomerate was accused of stock manipulation and fraud in the Hindenburg investigation on January 24.

The Adani Group has labeled Hindenburg an “unethical short seller,” claiming that the New York-based entity’s research was “nothing but a lie.” A short-seller in the securities market profits on the ensuing drop in share prices.