The Fixed Income Tactical Opportunities Fund (FITOF), a medium-term fixed-income fund denominated in USD and managed by SCUBE Capital based in Singapore, has been recognized as the top-performing USD fixed-income fund by Bloomberg. Surpassing global giants like Prudential, Nomura, Invesco, Eastspring, and Fullerton, FITOF excelled among funds with a focus on Asian countries such as China, India, Indonesia, and Vietnam.

As of January 30, 2024, FITOF achieved total returns of 13.78% over a one-year period, surpassing its China-focused counterpart by 109.9 basis points. SCUBE’s Medium Duration Opportunities Fund (MDOF), a closed-ended USD medium-term fixed-income fund, ranked third with one-year total returns of 10.35%, according to Bloomberg.

This recognition underscores SCUBE Capital’s investment prowess, disciplined investment approach, and deep understanding of local credit markets. While SCUBE funds primarily invest in high-quality USD bonds, they have shown a preference for Indian bonds over other regions.

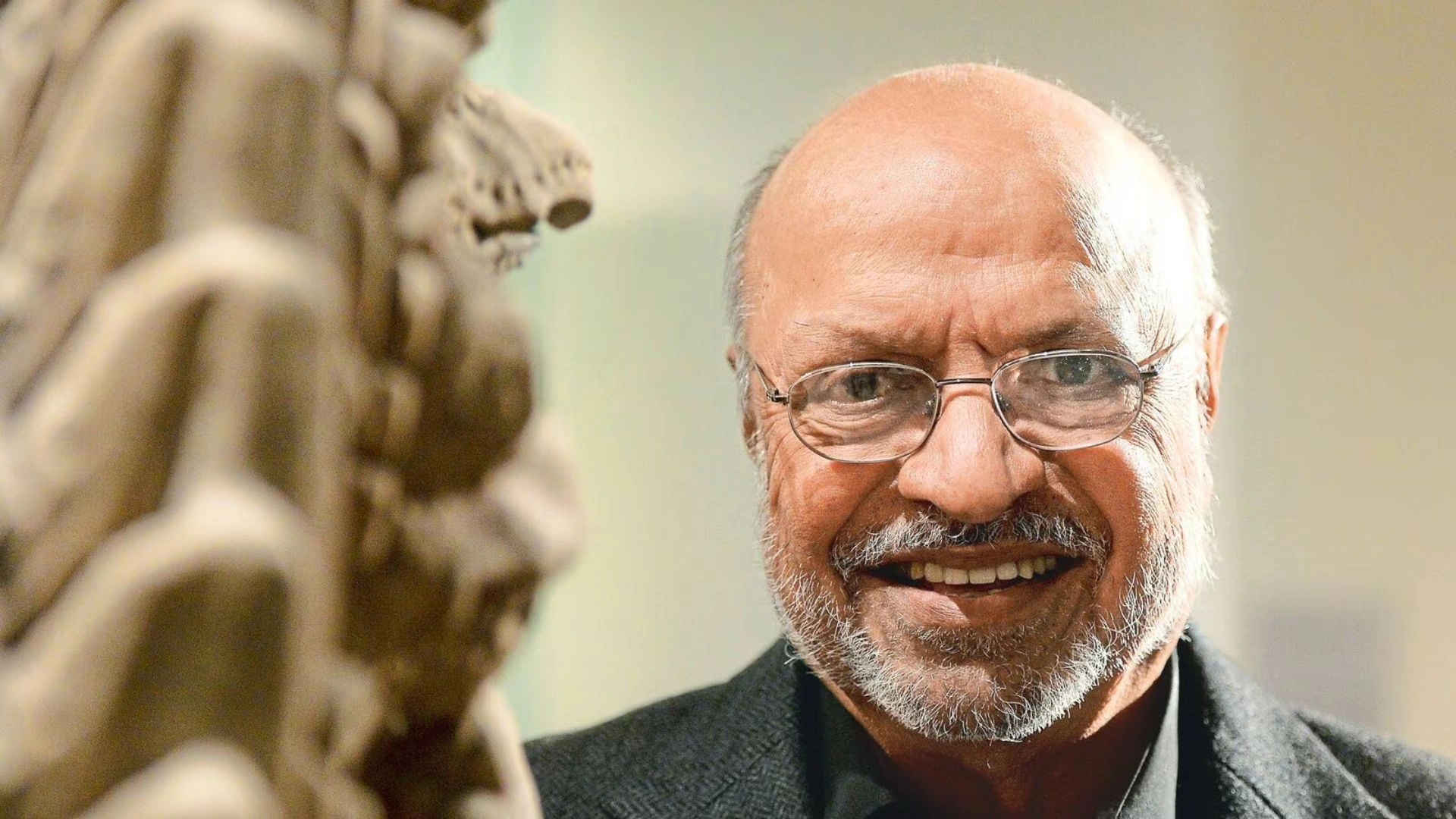

Hemant Mishr, Co-Founder and CIO of SCUBE Capital, expressed confidence in India’s growth story and highlighted the team’s conviction in India’s strong macroeconomic fundamentals. He emphasized a strategic shift from China to India, citing deflationary risks, defaults by major Chinese companies, and unfavorable geopolitics as factors influencing investor sentiment towards China.

Balaji Swaminathan, Co-Founder & CEO of SCUBE Capital, expressed gratitude for the recognition and reaffirmed the firm’s commitment to helping investors achieve their investment objectives. He emphasized SCUBE’s vision to serve as a bridge for global investors seeking expertise in Asia and India.

SCUBE Capital, a globally regulated fund management company headquartered in Singapore and overseen by the Monetary Authority of Singapore (MAS), boasts a dedicated team of internationally experienced professionals. With a track record of managing investments exceeding USD 50 billion and a collective experience of over 70 years in Asian Fixed Income, SCUBE is committed to delivering institutional investment expertise to its clients. The firm’s solutions-driven approach addresses clients’ evolving investment challenges, ensuring superior returns and client satisfaction.