Adani Energy Solutions Limited (“AESL”), part of the globally diversified Adani portfolio and the largest private transmission and distribution company in India with a growing smart metering portfolio, today announced its financial and operational performance for the quarter and year ended March 31, 2024.

“AESL’s consistent progress in commissioning of new lines, along with robust energy demand, and our ability to recognize and tap market opportunities within the areas of interest continues to propel our growth and keeps us at the forefront of energy transition in India. We are proud of our contribution to developing critical transmission infrastructure, to facilitate renewable evacuation and as well as strengthening the existing grid. An ESG score of 25.3 from Sustainalytics in their recent assessment placed us to be one of the amongst top 20 electric utilities and helped surpass global and industry averages. This demonstrates our unwavering dedication to reduce environmental impact and promote sustainable practices,” said Anil Sardana, MD, Adani Energy Solutions.

Q4 FY24 Highlights:

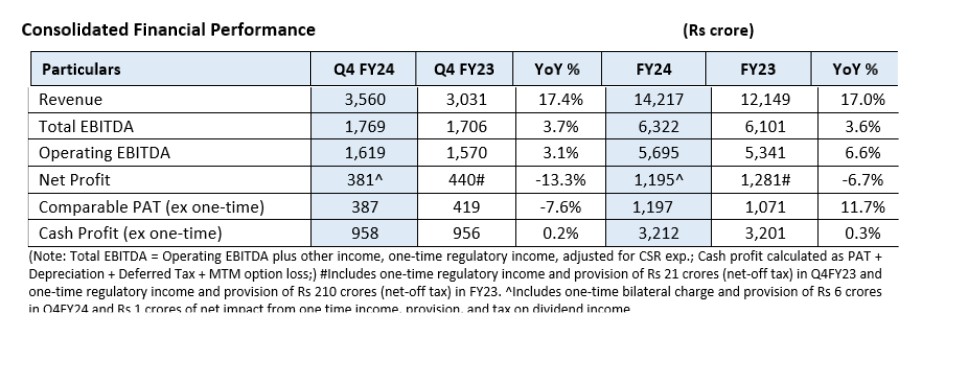

Consolidated Financial Performance

Revenue: Revenues witnessed a double-digit growth of 17% on account of the contribution from the newly operationalized transmission assets, commissioning of elements at North Karanpura and MP-II package lines and an increase in the units sold because of higher energy consumption in the distribution business at Mumbai and Mundra.

• Key transmission projects that were commissioned in FY24:

-> Commissioned largest 765 kV Warora-Kurnool transmission line strengthening the national grid and facilitating the seamless flow of 4,500 MW of power between Western and Southern regions and bolstering the Southern region’s grid for efficient integration of renewable energy sources

-> The 765 kV KBTL (Khavda Bhuj line), with 217 circuit kilometers, will help evacuate about 3 GW of renewable energy from Khavda, Gujarat. The project will help shape one of the country’s largest solar and wind farms

-> Commissioned 400 kV Kharghar-Vikhroli double circuit transmission line, establishing the first-ever high voltage 400 kV connection in Mumbai. This will enable an additional 1,000 MW power to be brought into Mumbai, thus meeting the city’s fast-growing electricity demand

-> Completed the Karur Transmission Ltd (KTL) project by establishing the 400/230 kV, 1000 MVA Pooling Station and an associated transmission line in Tamil Nadu

* Strong transmission system availability of 99.6% at the portfolio level

* AEML, the Mumbai distribution business witnessed an increase in the energy consumed by 9.4%. It saw one of the lowest distribution losses of 5.29% in its history and added new consumers, reaching 3.18 million on the back of reliable and affordable power supply

EBITDA:

-> The operational EBITDA increased by 3% to Rs 1,619 crore for the quarter, with incremental revenue contribution from Warora-Kurnool, Karur, Kharghar-Vikhroli and MP-II lines and steadily regulated EBITDA from the Distribution business. For the full year, the operational EBITDA grew by 7% to Rs 5,695 crore. The transmission business continues to maintain the industry’s leading EBITDA margin of 91%

-> The total EBITDA of Rs 1,769 crore in Q4 and Rs 6,322 crore in FY24 ended 4% higher

PAT: Comparable PAT of Rs 1,197 crore in FY24 was 12% higher YoY. The PAT last year had a net one-time positive impact of Rs 210 crore (net-off tax) from regulatory income and provisions

Transmission:

-> On operational parameters, it was a strong year, with an average system availability of over 99.6%. Robust line availability resulted in an incentive income of Rs 104 crore in FY24

-> Operationalized 1,244 circuit kilometers during the year and ended with a total transmission network of 20,509 circuit kilometers

Distribution business (AEML):

-> Sold 9,916 million units vs. 9,062 million units last year on account of an uptick in energy demand

-> Distribution loss has been improving consistently and stands at 5.29% in FY24 as against 5.93% in FY23 and maintained supply reliability at over 99.9%

Segment-wise Progress and Outlook:

Transmission:

-> Robust under construction project pipeline worth Rs 17,000 crores are currently under the execution phase

-> The company is on track to commission the MP-II package, NKTL (North Karanpura), Khavda Phase-II, Part-A and the WRSR (Narendra-Pune) lines in the coming quarters

-> The near term (12-18 months), tendering pipeline for the industry is buoyant and upwards of Rs 1.10 lakh crore under various stages

Distribution:

-> The distribution business continues to show a steady performance with double digit revenue growth and expansion of RAB (regulatory asset base), supported by internal accruals. Total RAB for the distribution business has now reached Rs 8,485 crores from Rs 5,532 crores at the time of acquisition in 2018

-> AESL is exploring multiple areas and has applied for a parallel distribution license in Navi Mumbai in Maharashtra, Greater Noida (Gautam Buddha Nagar) in UP, and Mundra subdistrict in Gujarat

-> AEML, during the year, invested capital expenditure of over Rs 1,334 crore and reduced its long-term debt by Rs 855 crore through a bond buyback program

Smart Meters:

-> The new business segment is evolving well and will become sizeable in terms of contribution to AESL’s overall growth and profitability. It offers strong synergies to the distribution business

-> During the year, received contracts of 21 million meters from Andhra Pradesh, Maharashtra, Bihar, and Uttarakhand DISCOMs

-> The under-implementation pipeline now stands at 22.8 million smart meters, comprising nine projects with a contract value of over Rs 27,195 crore

ESG Updates:

-> Adani Electricity Mumbai successfully increased its renewable energy share in the overall electricity mix to an impressive 35%. AESL being the largest distributor in Mumbai, this achievement now positions the city as one of the world’s highest procurers of renewable power (solar and wind) in the total mix, surpassing major global megacities. The share was only 3% in FY21. This noteworthy accomplishment underscores Adani Electricity Mumbai’s commitment to sustainability and decarbonization of the grid. AESL remains committed to its target of 60% renewable share by FY27

-> CDP Climate Change 2023 score improves to ‘B’ from ‘D’, surpassing the Asia regional average of ‘C’ driven by environmental transparency and prompt actions on climate change

-> In a recent assessment by Sustainalytics, the ESG score improves to 25.3 from 32.8, placing the company amongst the top 30 global utilities and top 20 electric utilities tracked by Sustainalytics thereby beating the global and industry average scores

-> Achieved a solid ‘B’ rating in the CDP Supply Chain Engagement score above the global average of ‘C’

-> Secured a ‘B’ rating in the CDP Water Security 2023 score, underscoring AESL’s commitment to effective environmental management

Achievements and Awards:

-> Excellent Energy Efficient Unit Award in 24th National Award for Excellence in Energy Management 2023 from Confederation of Indian Industry (CII)

-> AEML, the Mumbai utility was rated ‘A’ in National Consumer Service Ratings by the Ministry of Power out of the 62 DISCOMs evaluated across India

About Adani Energy Solutions Limited (AESL):

AESL, part of the Adani portfolio, is a multidimensional organization with presence in various facets of the energy domain, namely power transmission, distribution, smart metering, and cooling solutions. AESL is the country’s largest private transmission company, with a presence across 17 states of India and a cumulative transmission network of 20,509 ckm and 57,011 MVA transformation capacity. In its distribution business, AESL serves more than 12 million consumers in metropolitan Mumbai and the industrial hub of Mundra SEZ. AESL is ramping up its smart metering business and is on course to become India’s leading smart metering integrator with an order book of over 22.8 million meters. AESL, with its integrated offering through the expansion of its distribution network through parallel licenses and competitive and tailored retail solutions, including a significant share of green power, is revolutionizing the way energy is delivered to the end consumer. AESL is a catalyst for transforming the energy landscape in the most reliable, affordable, and sustainable way.