Nirmala Sitharaman has finally started the preparations for this year’s Union Budget and the Finance Minister has issued directives to its officials to start the Budget formulation processes. She has pointed out the importance of thorough and detailed planning and an in-depth analysis.

The Union Budget is an important document and it has Constitutional provisions and backing. The union budget is enshrined in the as the Annual Financial Statement in Article 112 of the Indian Constitution.

According to reports, Parliament is expected to receive the Union Budget for the fiscal year 2024-25 by the third week of July. The anticipation is further mounting as the release of the economic survey will take place on July 3, which will be followed by the Union Budget announcement.

Finance Ministry In Quarantine

According to reports, preparations for Union Budget 2024-25 began on Thursday, prompting North Block, home to the finance ministry, to go into a ‘quarantine’ mode until the Budget is presented in July.

The Interim Budget

The Interim Budget holds a very specific importance as it is presented by the government while it is transitioning or it is its final year before the general elections.

It serves the purpose of continuity in government expenditure and essential services until the new government presents a comprehensive budget after assuming power.

In the interim budget released in February, the corporate tax rate saw a reduction of 8% from the previous 30% which brought the effective tax rate to 22%. Moreover, for certain new manufacturing industries, a special reduced rate of 15 was introduced as well.

Particulars Of The Union Budget

The Union Budget accounts for the government’s finances for the fiscal year, running from April 1st to March 31st. Traditionally, the Budget is presented to Parliament on February 1st (it was presented on the last working day of February until 2016) to ensure it is implemented before the new financial year begins on April 1st.

In 2017, a 92-year-old tradition was changed when the railway budget was merged with the Union Budget, and both were presented together. Before taking effect, the Budget must be passed by the Lok Sabha, the Lower House of Parliament.

The Union Budget is split into two parts: the Revenue Budget and the Capital Budget. The Budget outlines the government’s disbursements and receipts, encompassing various government funds in India: the Consolidated Fund of India, the Contingency Fund, and the Public Accounts. Additionally, the Economic Survey of India is released before the Budget presentation.

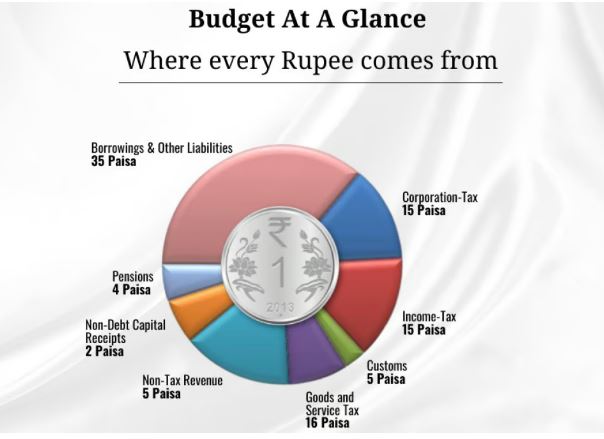

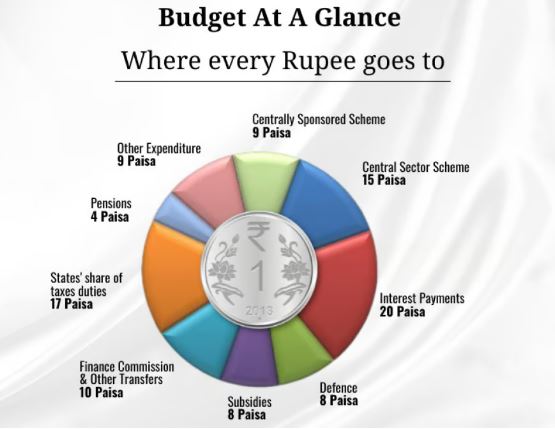

The Dynamics Of The Tax Structure Where Does The Rupee Come From And Where Does It Go?

Revenue

The government can generate its revenue from both tax and non-tax sources. Taxes are further classified into direct and indirect tax where your income tax comes under direct tax where whereas GST comes under Indirect taxes, customs, and excise are other examples of the latter. Further, not all income is generated through Taxes therefore the government also generates money through borrowings and government bonds.

Expenditure

Further, the government spends these revenue receipts in the form of revenue and capital expenditure. A major chunk of the receipts goes to government central sector schemes, Defence, and infrastructure. This is followed by the state’s share of taxes and after that, the government has to pay interest on the liabilities that it had incurred in the form of borrowings.

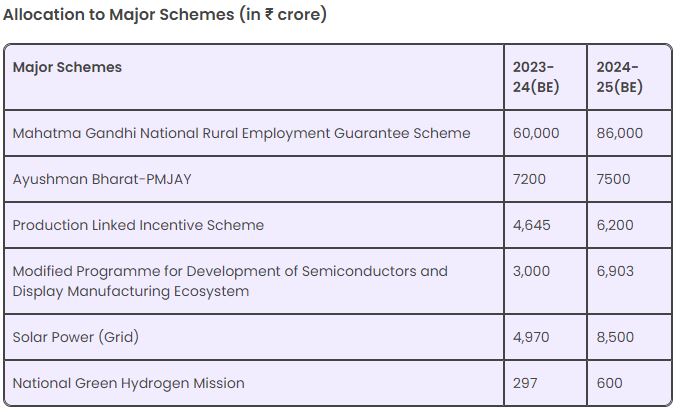

Below is a table that give an idea of the government spending on schemes, Defence, infrastructure etc.