Finance Minister Nirmala Sitharaman is unveiling her seventh consecutive budget, with many hoping for tax relief for the middle class. Despite an impressive 8.2% growth in the economy over the past fiscal year, private consumption—a critical driver of GDP—only increased by 4%.

In an effort to stimulate consumer spending, the government may propose cuts to personal income taxes, especially for those with high spending rates. According to a Bloomberg News report from last month, this adjustment could benefit individuals earning between ₹5 lakh and ₹15 lakh per year, who currently face tax rates from 5% to 20%.

New Income Tax Slabs Introduced

In India, income tax is based on a slab system where different rates apply to different income ranges. As your income increases, so does your tax rate, making the system fair and progressive. The tax slabs are updated yearly during the budget and can vary for different taxpayer groups

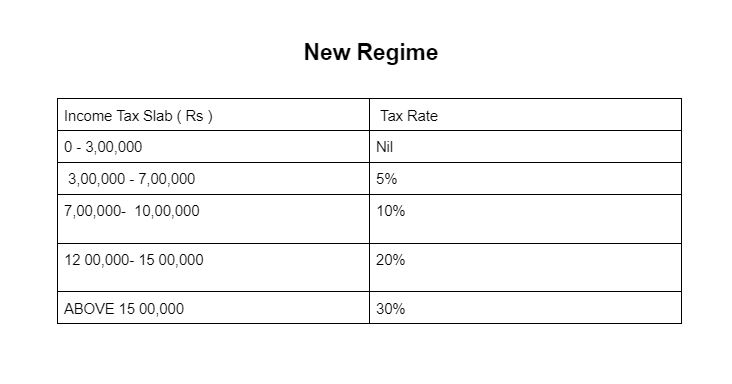

On personal income tax rates in new tax regime, FM Sitharaman says, “Under new tax regime, tax rate structure to be revised as follows – Rs 0-Rs 3 lakh -Nil; Rs 3-7 lakh -5% ; Rs 7-10 lakh-10% ; Rs 10-12 lakh-15%; 12-15 lakh- 20% and above Rs 15 lakh-30%.”

Under the new tax regime, individuals can save up to ₹17,500. The revised tax brackets are:

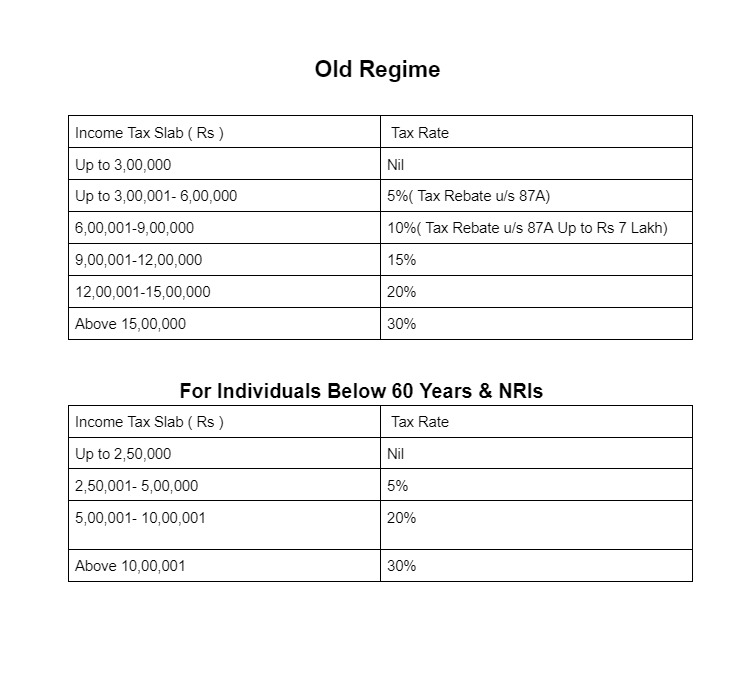

Comparison Of Previous Year’s Tax Slab with the Latest Budget

In contrast, the old regime featured a more complex structure with a broader range of tax rates and various exemptions. It included tax brackets such as 5% for income between ₹2.5 lakh and ₹5 lakh, 10% for ₹5 lakh to ₹10 lakh, 20% for ₹10 lakh to ₹12.5 lakh, and 30% for income above ₹12.5 lakh.

The old system also allowed for numerous deductions and exemptions, making tax calculation more intricate. The new regime’s simplified approach aims to make tax compliance easier and more transparent.

Increased Standard Deduction for Salaried Employees

One of the notable changes is the increase in the standard deduction for salaried employees. The deduction has been raised from Rs 50,000 to Rs 75,000. This enhancement will lead to substantial tax savings for employees, with an estimated reduction of Rs 17,500 in income tax for those in the new tax regime.

Increased Tax Relief for Family Pensioners

The government has proposed raising the tax deduction limit for family pensions from ₹15,000 to ₹25,000. This change aims to offer more financial support to pensioners and their families, highlighting the importance of securing financial stability for retirees.

Effects and Advantages

The new tax regime is set to make the tax filing process easier and more straightforward. By increasing the standard deduction and adjusting tax slabs, the policy is expected to leave salaried employees with more disposable income, which could encourage higher consumer spending and fuel economic growth.

Pensioners will benefit from the boosted deduction on family pensions, enhancing their financial security in retirement. Overall, these updates reflect the government’s commitment to improving the economic well-being of its citizens and creating a more efficient tax system.