The National Payments Corporation of India (NPCI) has reported a surge of interest from new participants in the Unified Payments Interface (UPI) ecosystem, with 50 new third-party application providers (TPAPs) eager to join. This interest comes despite the absence of a merchant discount rate (MDR), which has historically been a barrier for new entrants.

NPCI’s Perspective on Market Dynamics

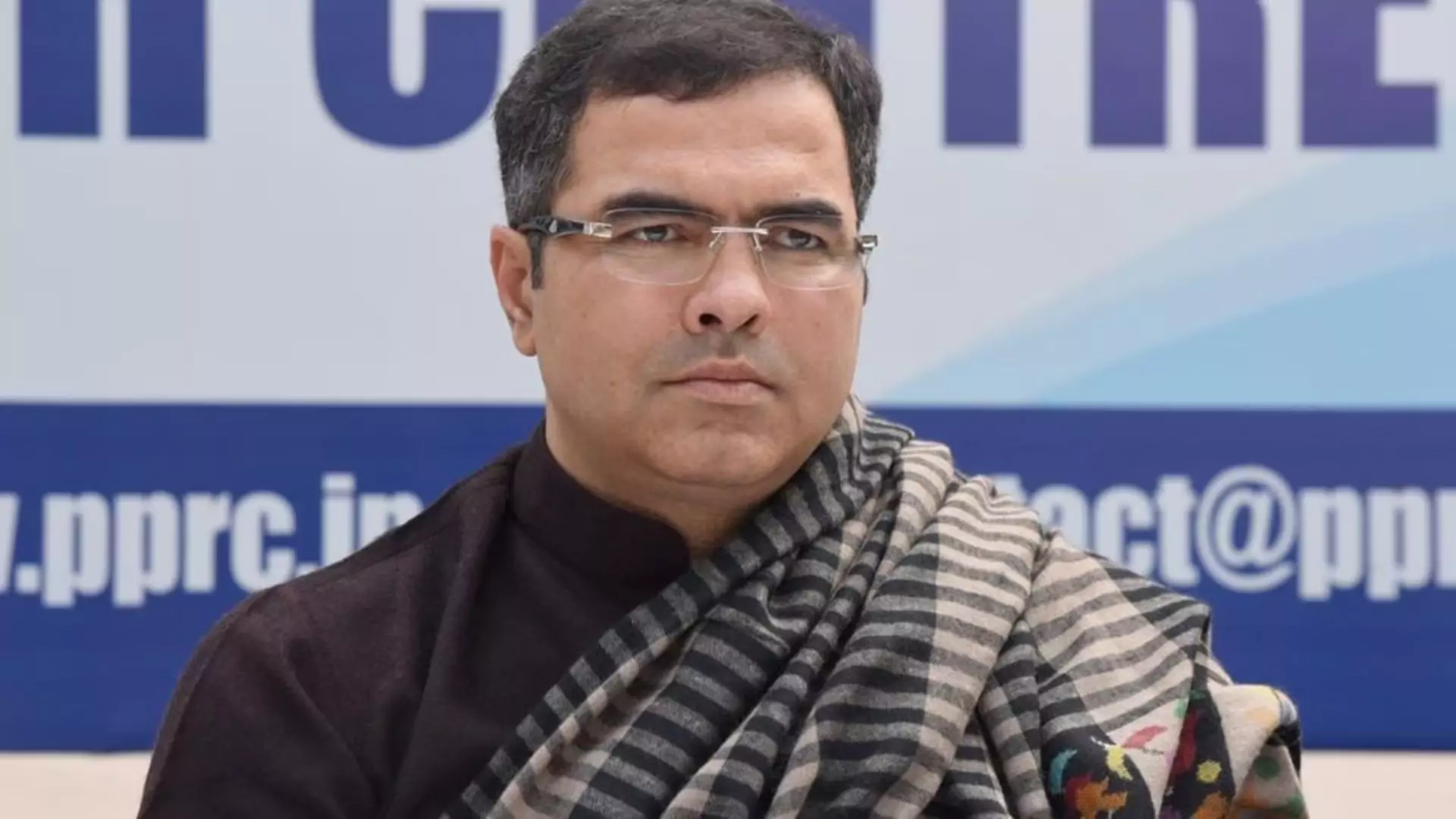

Dilip Asbe, the managing director and CEO of NPCI, highlighted that the lack of a revenue model on UPI had previously slowed the influx of new players. However, over the past year, the landscape has shifted dramatically. Asbe noted, “The revenue model on UPI had dried off the funnel of new players entering the market. In the last year, we have seen unprecedented interest, with almost 50 new TPAPs wanting to enter.”

The new entrants include notable names like Navi, BharatPe, and super.money. Currently, most UPI debit transactions are processed without any fees for consumers, with the costs absorbed by fintech companies and banks.

MUST READ: Asian Markets Decline As Chip Stocks Fall, China Remains In Focus

The Future of MDR in UPI Transactions

Asbe mentioned the potential for introducing an MDR specifically for larger merchants, stating, “I don’t think an MDR would come for smaller merchants defined as entities with a turnover of less than Rs 20 lakh. If it comes in, it would be for larger merchants.” An MDR is typically a fee charged to merchants by payment processors for facilitating digital transactions, including UPI.

Introducing an MDR could provide companies with a revenue stream from transaction processing, alleviating the financial burden currently shouldered by fintechs and banks.

Addressing Market Concentration Concerns

The UPI market has faced scrutiny over its concentration, with PhonePe and Google Pay processing approximately 87% of monthly UPI volumes. Asbe reassured stakeholders that the market would naturally self-correct as new use cases emerge. He pointed to NPCI’s introduction of innovative products like credit cards on UPI and credit lines as steps to diversify the ecosystem.

In November 2022, NPCI proposed a 30% cap on market share for third-party application providers to encourage competition. Asbe confirmed that while a decision on this cap is still pending, the goal remains a balanced market that fosters growth without stifling innovation.

Leveraging AI for Enhanced Security

NPCI is also integrating artificial intelligence (AI) into its operations to bolster risk and fraud management. The organization is utilizing AI for various purposes, including compliance with anti-money laundering (AML) guidelines and monitoring for mule accounts. This technological advancement is expected to improve the overall security and reliability of the UPI system.

The UPI ecosystem is on the brink of a transformative phase, with a significant influx of new players eager to participate. As the NPCI explores the potential introduction of MDRs and continues to address market concentration concerns, the future of digital payments in India looks promising. The emphasis on AI for risk management further enhances confidence in the robustness of this payment infrastructure.