Availing a car loan has become more convenient with the use of mobile banking applications, and the State Bank of India (SBI) offers the YONO app for this purpose. The YONO app provides a straightforward process for applying for car loans, making it accessible to existing SBI customers through self-service mode.

Key Features of Getting a Car Loan with SBI YONO App:

- Lowest Interest Rates and EMI: The YONO app offers competitive interest rates, low Equated Monthly Installments (EMI), quick disbursement, and minimal paperwork.

- Financing Options: SBI’s car loan through YONO can be used to purchase new passenger cars, Multi Utility Vehicles (MUVs), and SUVs.

- Repayment Tenure: The maximum repayment tenure is 7 years, and customers can get financing up to 90% of the “On-road price,” including registration and insurance.

- Interest Calculation: Interest is calculated on a daily reducing balance, and there are no foreclosure charges after 2 years.

- Flexi Pay Option: SBI provides a Flexi pay option where customers can choose between two options for the initial EMIs, making it more flexible.

- Interest Rates: The fixed rate of interest applied at the time of disbursement remains the same for the entire loan period. Interest rates for SBI Car Loan, NRI Car Loan, and Assured Car Loan Scheme range from 8.85% to 9.80%.

- Eligibility Criteria: Applicants should be aged between 21 to 70 years, and there are income criteria for both salaried and self-employed individuals.

How to Avail a Car Loan through SBI YONO App:

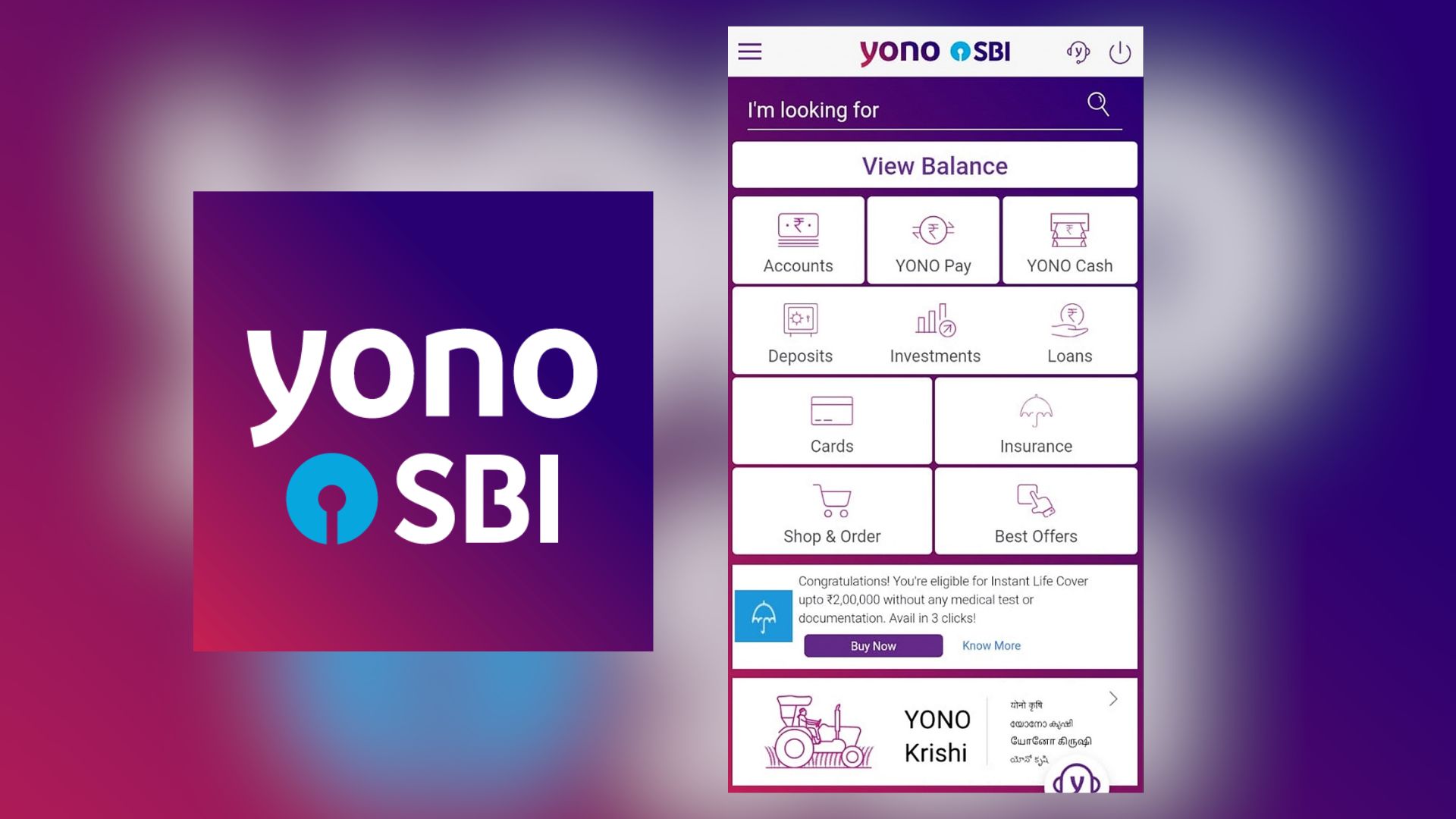

- Download and Register/Login to YONO: Users need to download the YONO app, register, or log in to their account.

- Navigate to Loan Section: In the navigation bar or hamburger menu, click on the “Loan” section.

- Select Car Loan: Choose the “Car Loan” option and click on “Apply Now.”

- Complete the Application: Follow the prompts to complete the car loan application.

- Accept Terms and Conditions: Review the terms and conditions and accept them to proceed with the application.

By following these steps, users can easily apply for a car loan through the SBI YONO app, benefiting from its user-friendly interface and convenient features.

Advertisement · Scroll to continue