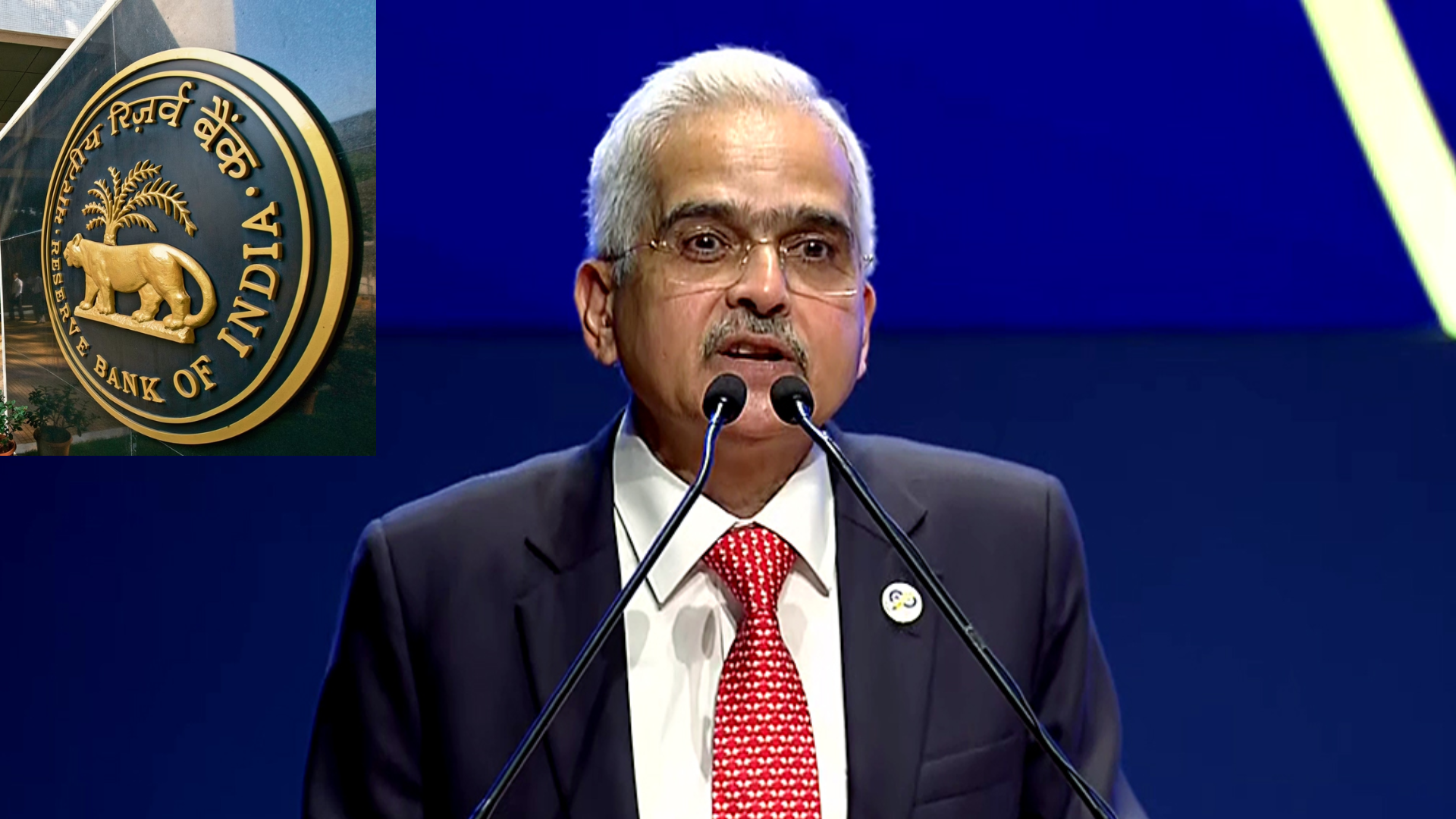

RBI Governor Shaktikanta Das, in the unveiling of decisions from the first monetary policy committee meeting of FY25, highlighted the importance of monitoring inflation while making significant announcements. The Consumer Price Index (CPI) inflation projections for FY25 have been revised down to 4.5 per cent from the earlier estimate of 4.7 per cent.

Das referred to the previous high CPI inflation of 7.8 per cent in April 2022 as the “elephant in the room.” He noted that with the current inflation trend, the “elephant has now gone out for a walk, and appears to be returning to the forest.”

“Assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent. The risks are evenly balanced,” Das stated.

RBI retains inflation forecast at 4.5% with risk evenly balanced assuming normal monsoon for current fiscal, says Shaktikanta Das #RBIpolicy

— Shaktikanta Das RBI News (@ShaktikantaRBI) April 5, 2024

While inflation has shown a significant decrease, it remains above the 4 per cent target set by the RBI. Das mentioned that deflation in fuel prices is expected to deepen in the near term due to the reduction in LPG prices in March and the anticipation of a normal monsoon this year.

The inflation rate in India has declined to 5.1 per cent in January and February 2024 from 5.7 per cent in December 2023, which was the peak. Governor Das emphasized, “Growth has continued to sustain its momentum, surpassing all projections. Headline inflation has eased to 5.1 per cent during both January and February, and this has come down to 5.1 per cent in these two months from the earlier peak of 5.7 per cent in December.”

Regarding India’s economic indicators, Das mentioned that the Current Account Deficit (CAD) has significantly narrowed. India’s exports of merchandise and services have seen substantial growth. The country’s Forex reserve has reached an all-time high, standing at 645.6 billion dollars. The Net Foreign Portfolio Investment (FPI) inflow to India stands at 41.6 billion dollars.

“In 2021, our forex reserves had also reached 642 plus billion US dollars. Then, following the commencement of the war in Ukraine and the outflow of dollars from India, as well as from several other countries on safe-haven demand, there were concerns that the forex reserves of India were going down,” the RBI Governor explained.

Additionally, Das remarked on the resilience of the global economy with a stable outlook. Global trade is expected to grow at a faster pace in the coming months. While global equity markets have shown gains, the dollar and bond market have exhibited volatility. Das expressed optimism for positive growth in 2024, noting that global trade is set to improve during the year.