SRM Contractors’ IPO, announced on March 26th, 2024, has attracted considerable attention from both retail and non-institutional investors. The subscription period for the IPO is scheduled to conclude today, March 28th, 2024.

According to data from the Bombay Stock Exchange (BSE), the subscription status of the SRM Contractors IPO reached 17.42 times on the second day, with the non-institutional investor (NII) segment oversubscribed by 45.51 times, the retail segment by 13.95 times, and qualified institutional buyers (QIBs) by 2.41 times. On the first day, the overall subscription was 3.56 times.

The price range for the SRM Contractors IPO is fixed between Rs 200 to ₹210 per share, with a face value of ₹10. Investors can bid for a minimum of 70 shares, and in multiples of 70 shares thereafter. The allocation for non-institutional investors (NIIs) is set at a minimum of 15% of the shares, while up to 50% is reserved for qualified institutional buyers (QIBs). Retail investors are assured a minimum of 35% of the shares.

The tentative allotment date for SRM Contractors IPO shares is Monday, April 1st. Shares are expected to be credited to the allottees’ demat accounts on Tuesday, April 2nd, which is also the refund day. The anticipated listing of SRM Contractors’ shares on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) is slated for Wednesday, April 3rd.

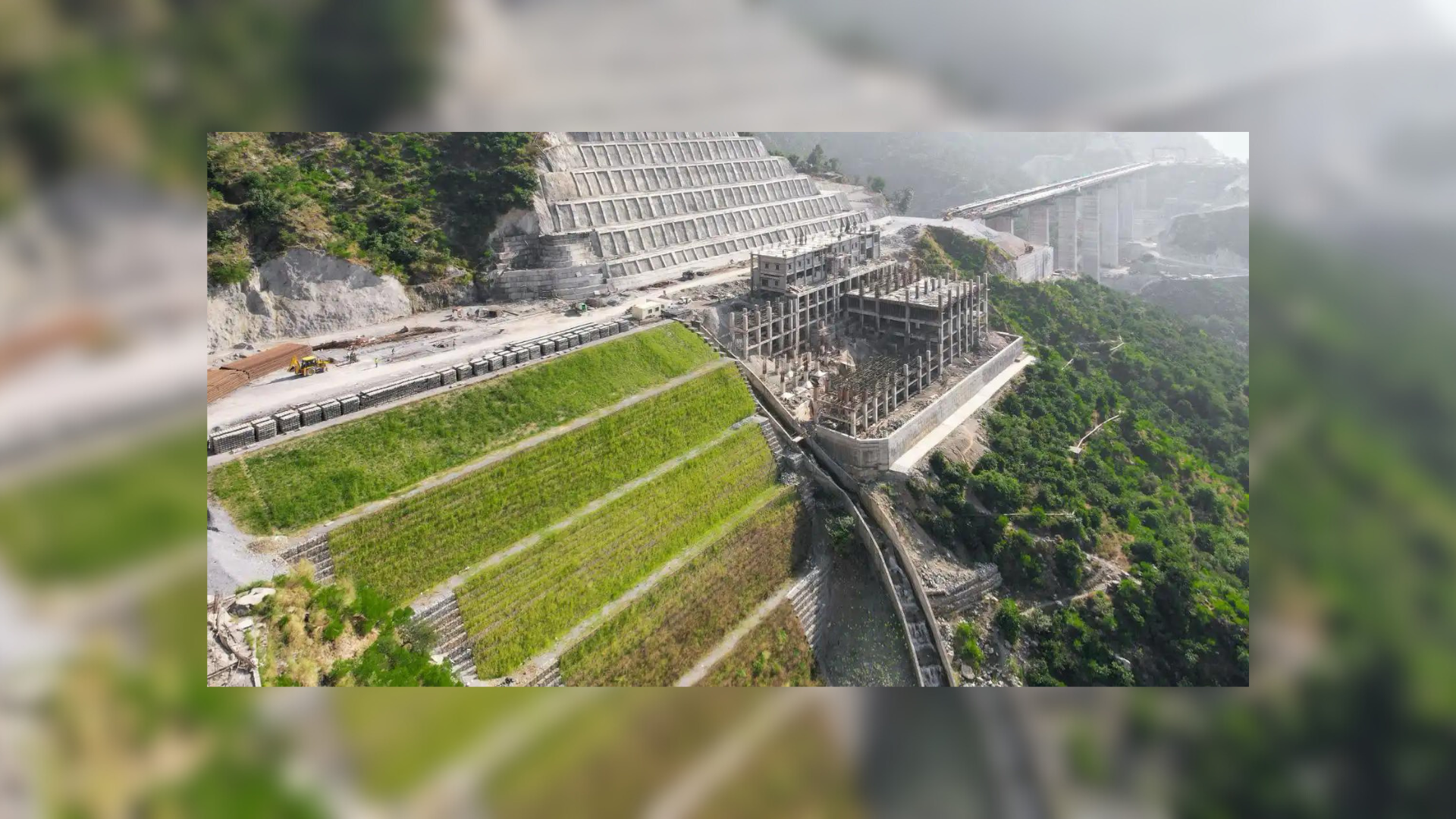

SRM Contractors is engaged in various civil construction projects in the Union Territories of Jammu & Kashmir and Ladakh, such as highways, tunnels, bridges, slope stabilization projects, and smaller-scale initiatives. The company’s proficiency in handling projects in the challenging terrain of the region has established it as a significant contributor to infrastructure development in these territories.

The SRM Contractors IPO involves a fresh issue of up to 62,00,000 equity shares, totaling ₹130.20 crore, with no offer-for-sale component. The net proceeds from the IPO will be utilized for multiple purposes, including meeting working capital needs, repaying existing secured loans, participating in project-specific joint ventures, and fulfilling general corporate requirements. Additionally, funds will be allocated for capital expenditures related to machinery and equipment acquisition.

The Grey Market Premium (GMP) for the SRM Contractors IPO currently stands at +115, indicating a premium of ₹115 per share. Analysts estimate the GMP to range between ₹25 to ₹115. The expected listing price of SRM Contractors shares is ₹325 each, representing a 54.76% increase over the IPO price of ₹210, considering the upper end of the IPO pricing band and the current premium in the grey market. This positive trend in the IPO GMP indicates optimism for a robust listing, based on recent grey market activity.

In response to an image of the charred Tesla vehicles circulating on X, Musk called…

Tamil Nadu’s ruling party, Dravida Munnetra Kazhagam (DMK), has long opposed the National Education Policy’s…

In a viral TikTok, the content creator detailed the harrowing six months she spent in…

Messi has been vocal about his approach to the later stages of his career. In…

Scammers trick people by reaching out through social media, such as Telegram or WhatsApp, promising…

Kristen Fischer, a mother of three, took to Instagram to highlight eight key reasons why…