The Reserve Bank of India (RBI) has significantly reduced India’s GDP growth forecast for FY25, lowering the estimate from 7.2% to 6.6%. This adjustment reflects concerns about the slowing economic activity, particularly the weakness in the manufacturing sector.

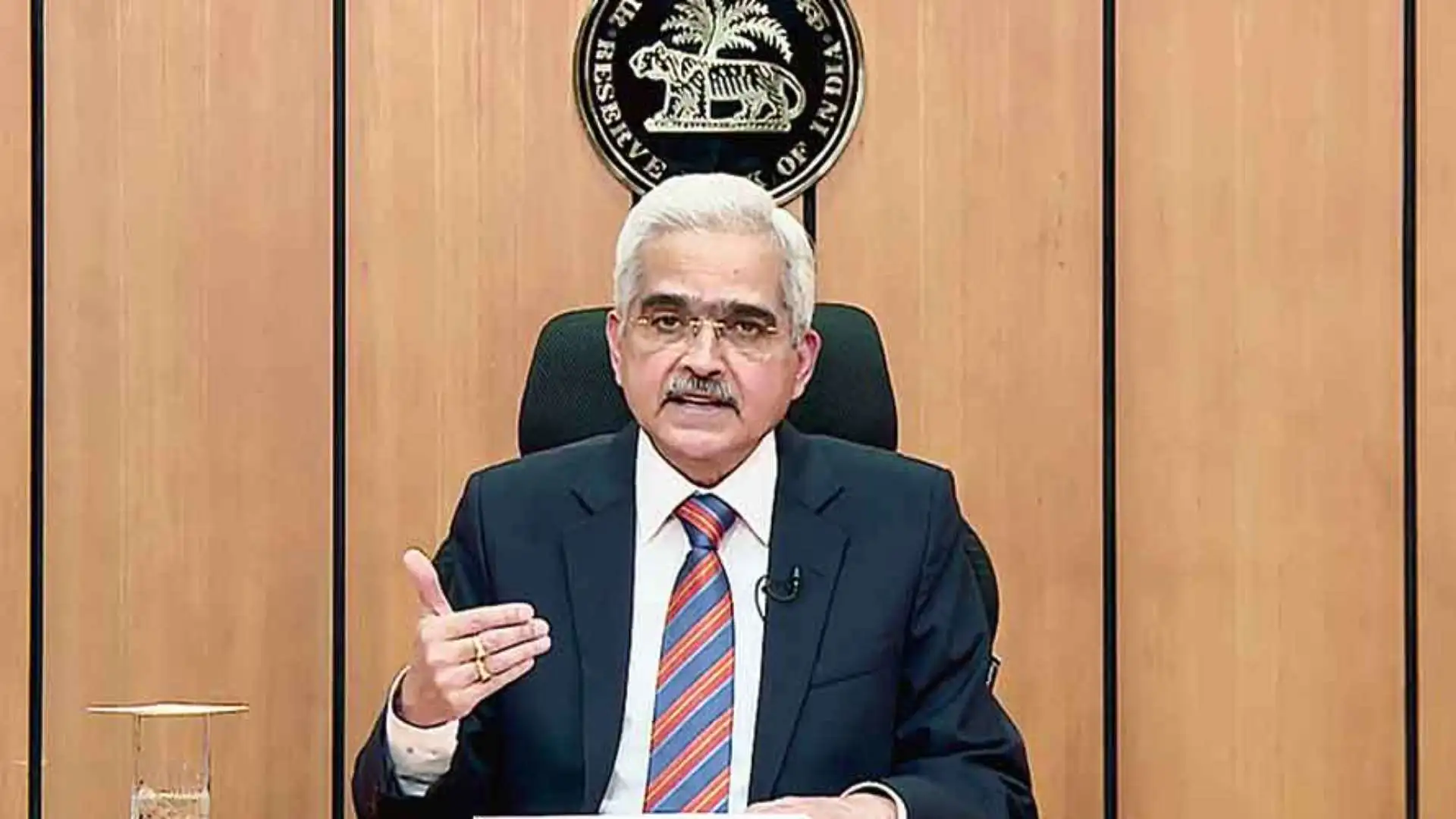

Governor Shaktikanta Das, while announcing the new growth forecast on Friday, highlighted that growth in the second quarter of FY25 was much weaker than expected, at just 5.4%. The decline was primarily attributed to a sharp drop in industrial growth, which plummeted from 7.4% in Q1 to just 2.1% in Q2. This slowdown was largely driven by poor performance in sectors like petroleum products, iron and steel, and cement, coupled with reduced mining and electricity demand.

Despite this, the RBI governor remained optimistic, stating that high-frequency indicators suggest the worst of the slowdown has passed. A recovery is anticipated, driven by a strong festive demand and a resurgence in rural activities. Industrial output, according to Das, is expected to normalize in the coming months.

In light of the sluggish growth, the RBI’s Monetary Policy Committee (MPC) voted by a majority of 4:2 to maintain the repo rate at 6.5%. This marks the 11th consecutive meeting where the key lending rate has remained unchanged. The decision reflects the RBI’s efforts to balance inflation control with encouraging economic recovery.

Despite the revised forecast, the RBI remains cautious but hopeful that the economic recovery is on the horizon. However, the slowing growth in key sectors will need to be monitored closely as the economy moves into the final quarters of FY25.

ALSO READ: SBI Q2 Results: Net Profit Up 28%, Asset Quality Improves, Shares Dip 2%