In a widely anticipated move, the Reserve Bank of India’s Monetary Policy Committee (MPC) on Tuesday announced a 25 basis point cut in the repo rate, bringing it down to 6%. The decision comes amid mounting global economic uncertainties and a cautious domestic outlook on inflation and growth.

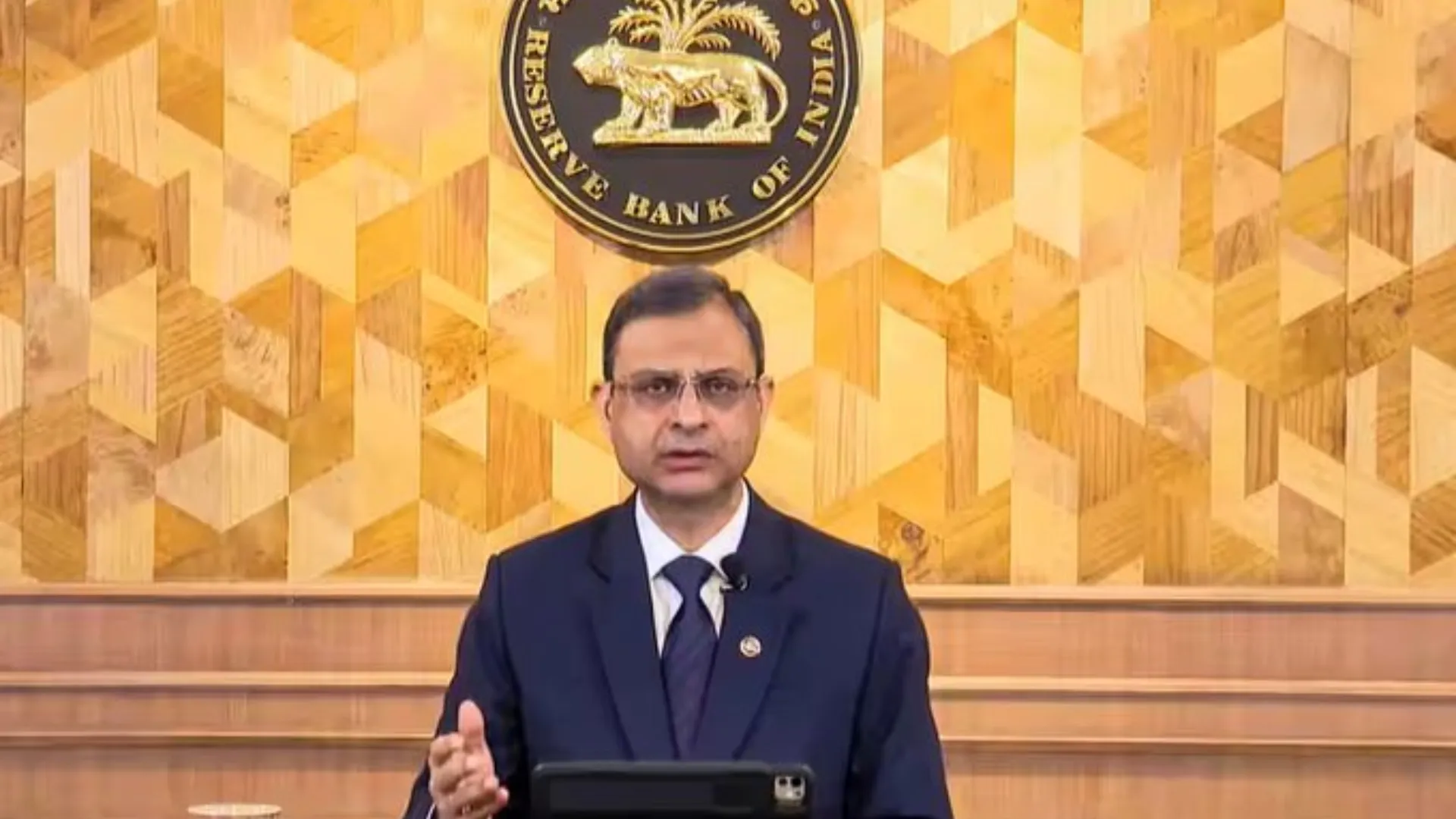

RBI Governor Sanjay Malhotra, delivering his first policy speech for FY26, confirmed that the policy stance has been shifted from ‘neutral’ to ‘accommodative’, signalling room for further easing if necessary.

“Global Headwinds, But Inflation Under Control”: Malhotra

Addressing the press after a three-day MPC meeting held from April 7 to 9, Malhotra said, “The global economic outlook is rapidly evolving. Recent tariff hikes and trade tensions have only deepened uncertainty, creating new headwinds for growth and inflation worldwide.”

He added that while food inflation has shown a sharper-than-expected decline, providing a degree of comfort, the central bank remains alert to potential risks emerging from global volatility and weather-related disruptions.

Growth Shows Signs of Recovery

Commenting on the domestic scenario, Malhotra noted that India’s growth trajectory is gradually improving after a subdued performance in the first half of FY24-25. “Though not yet at levels we aspire for, the momentum is picking up,” he said.

Revised Policy Rates

With immediate effect, the following rates have been adjusted:

- Repo Rate: 6.00%

- Standing Deposit Facility (SDF): 5.75%

- Marginal Standing Facility (MSF) & Bank Rate: 6.25%

The MPC stated that inflation is now comfortably below the 4% target, largely driven by easing food prices. “There is a decisive improvement in the inflation outlook,” Malhotra said, adding that projections suggest a sustained alignment with the 4% target over the next year.

Must Read: RBI Set To Announce First Policy of FY26 Amid Global Trade Uncertainty