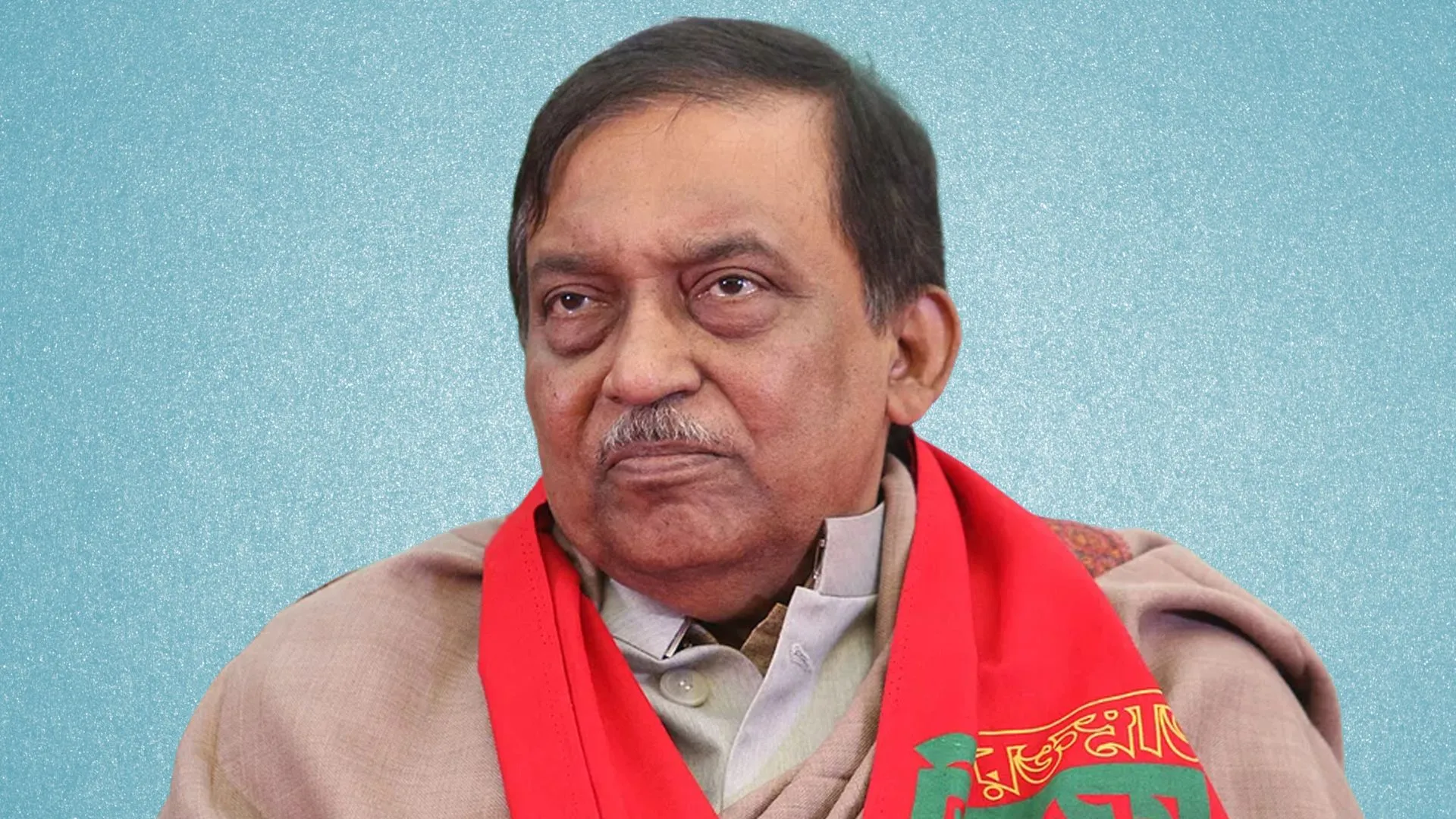

Hariprasad SV, the whistleblower who exposed the multi-crore Punjab National Bank (PNB) scam, has welcomed the arrest of fugitive diamantaire Mehul Choksi in Belgium. Choksi, a prime accused in the ₹13,500 crore PNB loan fraud case, was arrested on Saturday following an extradition request by Indian authorities.

Speaking to news agency ANI, Hariprasad called the arrest a “great moment” not just for India, but also for all the people who were duped by Choksi and his businesses.

“Wow, Mehul Choksi getting arrested in Belgium is great news not only for India but also for all those who got cheated by him. The government must bring him back to India as soon as possible, and justice must be delivered,” he said.

Hariprasad further emphasized the importance of recovering the stolen funds, stating:

“Apart from bringing him back, the most important thing is to get back all those billions of dollars he looted from India and stashed anywhere in the world. Hopefully, the Government of India will succeed this time.”

“Extradition is not an easy task. Choksi’s wallet is full, and he will employ the best lawyers in Europe to avoid the process like what Vijay Mallya has been doing. I don’t think it is going to be easy for India to get him back,” he said.

#WATCH | On fugitive Mehul Choksi, Punjab National Bank Scam whistle-blower Hariprasad SV says, “…The process we have to follow when we are dealing with a foreign country depends on the country that we are dealing with. The laws and the legal systems are going to take place. It… pic.twitter.com/Mv5KjCZuDg

— ANI (@ANI) April 14, 2025

Choksi’s Arrest in Belgium

Mehul Choksi, who had been absconding since 2018, was traced to Belgium, where he had reportedly gone for medical treatment. Authorities in India, including the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED), had been pursuing his extradition in connection with the ₹13,000 crore loan fraud.

Choksi, along with his nephew Nirav Modi, is accused of defrauding PNB by obtaining fraudulent Letters of Undertaking (LoUs) and Foreign Letters of Credit (FLCs) without proper approvals or collateral.

How the PNB Scam Was Uncovered

The scam first came to light in 2016 when Hariprasad SV wrote to the Prime Minister’s Office pointing out irregularities in PNB’s financial records. His alert led to one of India’s biggest banking fraud investigations.

According to the CBI, between March and April 2017, officials at PNB’s Brady House branch in Mumbai issued 165 LoUs and 58 FLCs to Choksi’s companies without proper documentation or entry into the bank’s core systems. These guarantees were then used to secure credit from several overseas banks including SBI (Mauritius and Frankfurt), Allahabad Bank (Hong Kong), Axis Bank (Hong Kong), and others.

As the companies failed to repay, PNB was forced to pay nearly ₹6,345 crore (approximately USD 965 million) to the foreign banks.

Choksi had been residing in Antigua and Barbuda since 2018, having acquired citizenship there. With his arrest in Belgium, Indian authorities hope to expedite his extradition and bring him back to face legal proceedings.

(With ANI Inputs)