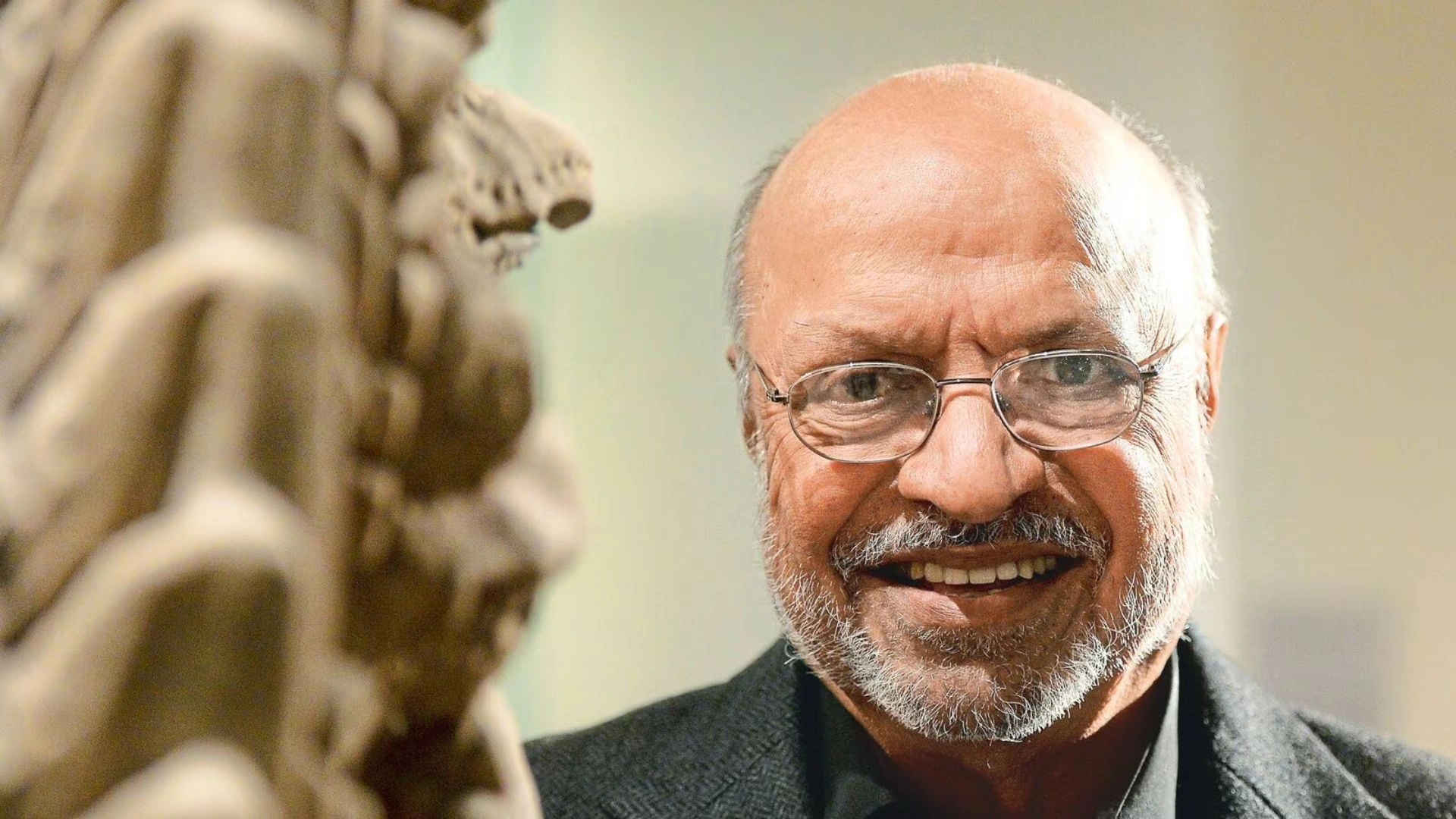

Shiva Gopal Mishra, General Secretary of the All India Railwaymen’s Federation, expressed gratitude to Prime Minister Narendra Modi for the approval of the Unified Pension Scheme (UPS) by the Union Cabinet on Saturday.

Mishra highlighted that the committee led by former finance secretary TV Somanathan, which recommended the UPS, had accepted nearly all the demands of the Central government employees’ representatives.

“Almost all our demands have been accepted. 23 lakh beneficiaries of the UPS take this step positively. Prime Minister Narendra Modi himself took cognisance of this and he held talks with us about this, for which I thank him,” Mishra told ANI on Sunday.

Unified Pension Scheme Approved: Key Benefits and Changes Explained

The Unified Pension Scheme includes provisions for a fixed pension amount, ensuring a guaranteed sum of money that retirees will receive regularly after retirement.

The UPS ensures that all central government employees who have served for 25 years or more will receive 50 percent of their last drawn salary from the past 12 months as pension. Additionally, these employees will be eligible for post-retirement inflation-linked increments in their pension amount.

In April 2023, a committee headed by then finance secretary TV Somanathan recommended the Unified Pension Scheme, which received approval from the Modi Cabinet on Saturday.

Under the UPS, there is a provision for a fixed and assured pension, unlike the National Pension System (NPS), which does not promise a fixed pension amount.

For employees who have completed 25 years or more of service, the UPS provides a pension amounting to 50 percent of their basic pay earned during the last 12 months preceding retirement. Employees with a minimum of 10 years of service will also be eligible for a pension, adjusted proportionally based on their years of service, with a minimum pension amount of Rs 10,000 per month.

The retirement benefits under UPS also include an assured family pension, amounting to 60 percent of the employee’s basic pay, in case of the employee’s premature death.

Inflation-linked indexation benefits will be applied to the assured pension, assured family pension, and assured minimum pension under the UPS.

The UPS also offers gratuity, a lump-sum amount paid upon retirement. The gratuity amount is calculated using the old formula: one-tenth of the monthly emolument (pay plus dearness allowance as of the retirement date), based on every six months of service.

Additionally, the UPS guarantees that 6 percent of the pension will be immediately transferred to the employee’s family as a family pension, similar to the benefits offered under the Old Pension Scheme (OPS).

The government describes the UPS as having five key pillars: assured pension, assured family pension, assured minimum pension, inflation-linked indexation, and gratuity upon retirement.

The National Pension System (NPS), introduced in January 2004, was initially established as a retirement plan exclusively for government employees. In 2009, it was expanded to cover all sectors. The NPS is governed jointly by the government and the Pension Fund Regulatory Authority (PFRDA).

NPS provides for a pension along with investment growth. Upon retiring, employees can withdraw a portion of their accumulated savings, while the remaining sum is used to provide a monthly pension.

Under the NPS, employees can withdraw up to 60 percent of the total corpus upon reaching retirement age, with no taxes charged on the amount. The remaining 40 percent is used to purchase an annuity product, which provides monthly pension returns to the subscribers.

However, under the OPS, pensions for central and state government employees were fixed at 50 percent of their last drawn basic pay, similar to the UPS structure. A dearness allowance (DA) was also included to compensate for the rise in the cost of living, as is done under UPS.

Moreover, under the OPS, employees were entitled to a gratuity payment of up to Rs 20 lakh upon retirement. In cases where a retired employee passes away, their family receives continued pension benefits. Additionally, no deductions were made from an employee’s salary towards pension contributions under the OPS, unlike the NPS.

The government states that the new Unified Pension Scheme (UPS) combines the benefits of both the OPS and the NPS. From the OPS, the UPS incorporates features such as an assured pension, inflation-linked indexation, a family pension, and a minimum pension.

From the NPS, the UPS adopts a feature that allows employees to contribute towards their pension fund if they desire a more personalized and higher pension upon retirement.

Under the UPS, the government has also increased its contribution from 14 percent, as currently stipulated under the NPS, to 18.5 percent. Employee contributions will remain the same.

Also Read: Centre Launches Unified Pension Scheme: Top Benefits For 23 Lakh Employees Revealed