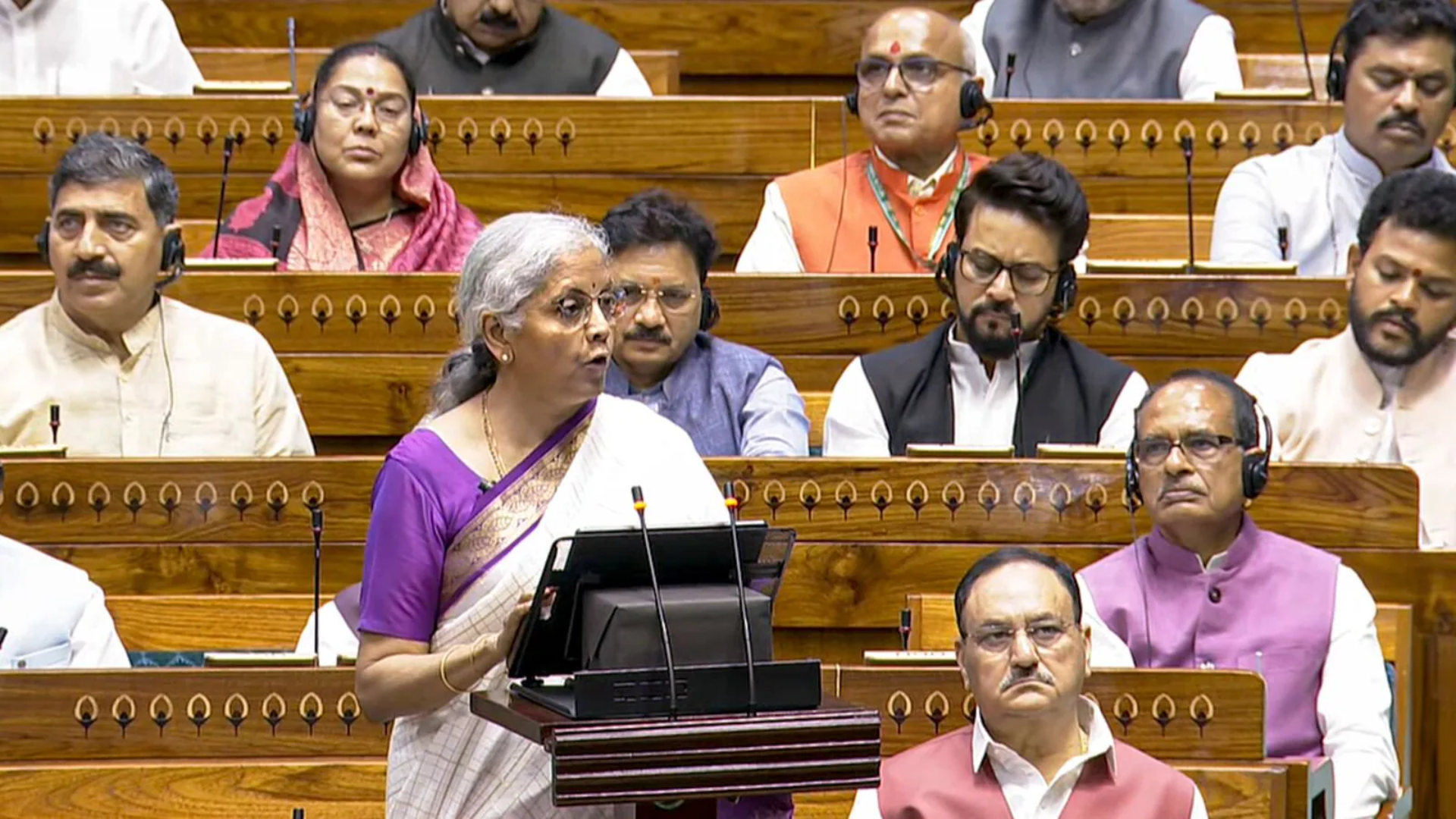

In the Union Budget 2024, Finance Minister Nirmala Sitharaman introduced significant changes to the income tax regime, aimed at providing relief to salaried employees and pensioners while simplifying the tax structure. These changes are expected to benefit a large section of taxpayers, ensuring increased disposable income and greater financial security.

Increased Standard Deduction for Salaried Employees:

One of the notable changes is the increase in the standard deduction for salaried employees. The deduction has been raised from Rs 50,000 to Rs 75,000. This enhancement will lead to substantial tax savings for employees, with an estimated reduction of Rs 17,500 in income tax for those in the new tax regime.

Revised Income Tax Slabs:

The income tax slabs under the new tax regime have been revised to provide a more progressive tax structure. The lowest tax slab has been increased from Rs 2.5 lakh to Rs 3 lakh. The revised slabs and corresponding tax rates are as follows:

- 0 – 3 lakh: Nil

- 3 – 7 lakh: 5%

- 7 – 10 lakh: 10%

- 10 – 12 lakh: 15%

- 12 – 15 lakh: 20%

- Above 15 lakh: 30%

These adjustments are designed to offer greater tax relief to individuals across different income levels, thereby encouraging higher compliance and easing the tax burden on middle-income groups.

Enhanced Tax Deduction on Family Pension:

The government has also proposed an increase in the tax deduction on family pension. The deduction limit has been raised from Rs 15,000 to Rs 25,000. This move aims to provide additional financial relief to pensioners, recognizing the importance of supporting retired individuals and their families.

Impact and Benefits:

The revised tax regime is expected to simplify the tax filing process, making it more transparent and taxpayer-friendly. The increased standard deduction and revised tax slabs will result in higher disposable incomes for salaried employees, which in turn could boost consumer spending and stimulate economic growth.

For pensioners, the enhanced deduction on family pension provides much-needed financial relief, ensuring better financial stability during retirement. Overall, these changes reflect the government’s commitment to supporting the financial well-being of its citizens while fostering a more efficient tax system.