In an endorsement of the Financial Stability Board’s (FSB) high-level recommendations regarding the regulation of crypto-assets, the G20 leaders, through the Delhi Declaration, emphasized their continued vigilance over the rapidly evolving crypto ecosystem’s risks.

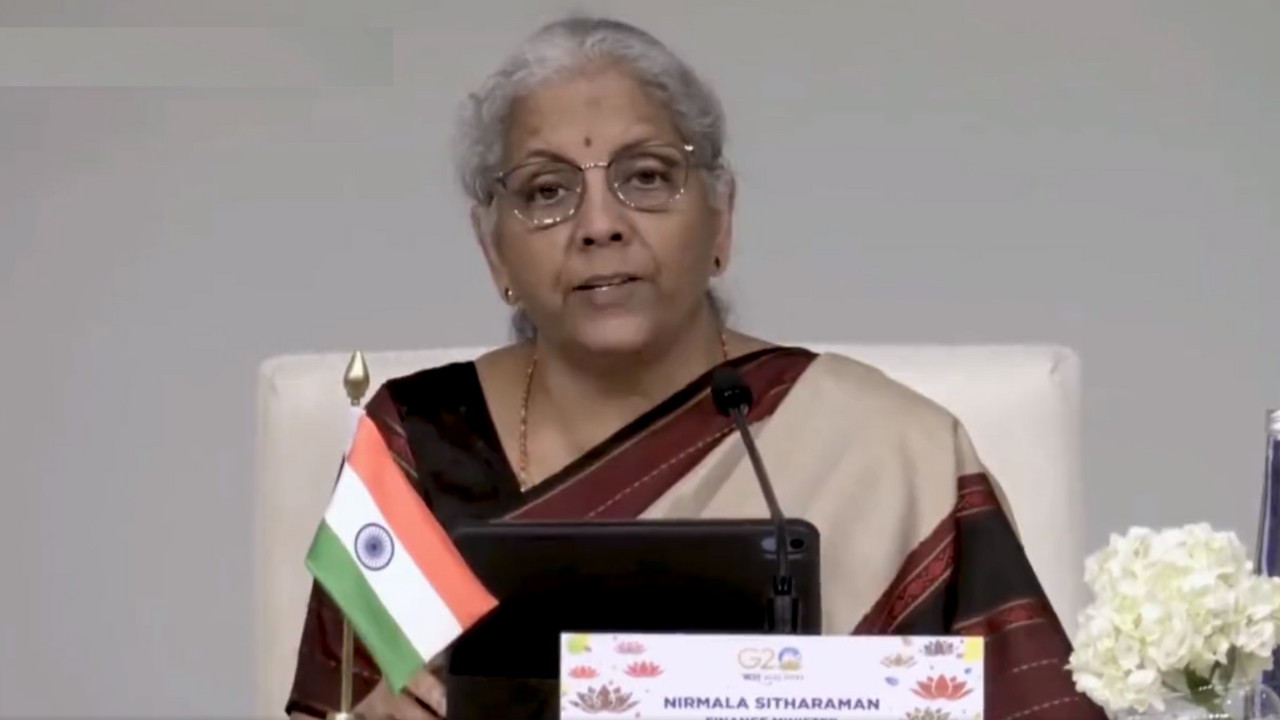

The Delhi Declaration document conveyed a request to the FSB and SSBs (standard-setting bodies) to facilitate the effective and timely global implementation of these recommendations, aiming to prevent regulatory inconsistencies that could lead to regulatory arbitrage.

Just two days prior to the G20 Summit meeting in New Delhi, the International Monetary Fund (IMF) and the FSB collaborated on a paper addressing crypto-assets. This paper highlighted the imperative need for a comprehensive policy and regulatory response to mitigate the macroeconomic and financial stability risks posed by crypto-assets. The development of this paper came at the behest of the Indian G20 Presidency.

India’s stance on cryptocurrency has revolved around the belief that any regulatory legislation or ban on cryptocurrencies should only be executed following substantial international collaboration to evaluate the associated risks and benefits.

It’s noteworthy that crypto assets currently exist in a regulatory vacuum within India. The government refrains from registering crypto exchanges, maintaining that crypto assets, due to their borderless nature, necessitate “international collaboration.”

The paper emphasized that crypto assets, having been in circulation for over a decade, exhibit significant volatility and increasing complexity in their activities. The widespread adoption of crypto-assets carries potential risks that could disrupt monetary policy, bypass capital flow management measures, heighten fiscal vulnerabilities, divert resources away from the real economy, and pose a threat to global financial stability.

In response to these concerns, the paper advocated for comprehensive regulatory and supervisory oversight as a foundational measure to address macroeconomic and financial stability risks. It highlighted the emergence of discernible risks that mandate suitable policy responses.

The Delhi Declaration reiterated the endorsement of the FSB’s high-level recommendations pertaining to the regulation, supervision, and oversight of crypto-assets activities and markets, as well as global stablecoin arrangements. It urged the FSB and SSBs to work toward the effective and consistent global implementation of these recommendations, thus averting regulatory disparities.

The Declaration also disclosed that discussions about advancing the roadmap would be held during the meeting of Finance Ministers and Central Bank Governors in October 2023.

A significant aspect of the Delhi declaration was that all 83 paragraphs were unanimously approved with 100 percent consensus, including agreement from China and Russia. Notably, the declaration did not contain any footnotes or a chair’s summary for the first time.

Also Read: G20 Summit: Delhi Traffic Police issues alert on second day

Catch all the Latest Business News, Breaking News Events, and Latest News Updates on NewsX

The study suggests the increased risk may stem from the adverse effects of antidepressants, but…

Singh, widely known for his viral “Yeshu Yeshu” videos, was found guilty under multiple sections…

In a move to spark meaningful discussions on child psychology, UK Prime Minister Keir Starmer…

A tragic incident in Bihar's Sitamarhi district has led to the death of a 22-year-old…

Rescue operations are currently underway, with emergency teams working to control the fire and evacuate…

A statement by Muhammad Yunus, the Chief Advisor of Bangladesh’s interim government, has stirred significant…