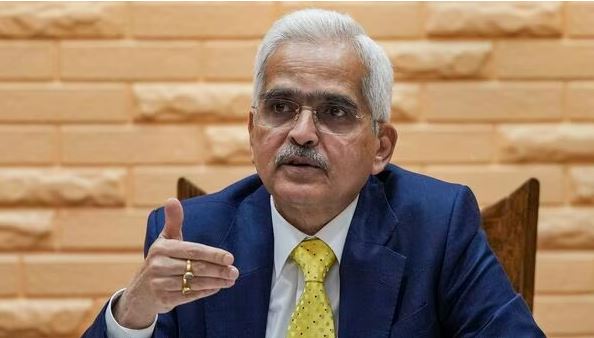

RBI Governor Shaktikanta Das reaffirmed on Monday the meticulous consideration behind every decision made by the Central bank. His remarks came in response to inquiries regarding specific restrictions imposed on Paytm Payments Bank. Speaking at the 606th meeting of the Central Board of Directors of the Reserve Bank of India in New Delhi today, Governor Das firmly stated that there would be no reconsideration of the decision concerning Paytm Payments Bank.

“Reviewing the decision is hardly a consideration. The term ‘review’ isn’t quite fitting here. Our primary concern is to ensure customers encounter no inconvenience, which is why we’ve allowed a one-month grace period. The action was initiated on January 31st, and we’ve extended the deadline to February 29th, prioritizing customer welfare,” remarked the RBI Governor.

“We will be releasing a FAQ document this week. I urge everyone to await its publication. Decisions made at the Reserve Bank undergo thorough deliberation. Whether it’s a bank, payment bank, NBFC, cooperative bank, or any other entity, our interventions occur after extensive assessment over months or even years. While not singling out Paytm, our actions are always deliberate and considered,” added RBI Governor Shaktikanta Das.

Responding to numerous queries regarding Paytm Payments Banks, the RBI reiterated its forthcoming release of a comprehensive FAQ addressing the matter.

“I want to stress the importance of awaiting our upcoming FAQ release. It will comprehensively address all customer concerns. Our priority remains the seamless transition for customers and depositors. This is why we’ve allowed a one-month grace period. The action commenced on January 31st, and the deadline has been extended to February 29th. This extension aligns with our commitment to prioritizing customer and depositor interests during transitions,” emphasized RBI Governor Shaktikanta Das.

Earlier, on February 9, One 97 Communications Limited’s Board announced the establishment of a Group Advisory Committee chaired by former SEBI Chairman M Damodaran. The committee’s objective is to collaborate with the Board in reinforcing compliance and regulatory adherence.

In an official statement, the company highlighted the Committee’s composition, which includes seasoned professionals such as MM Chitale, a former president of the Institute of Chartered Accountants of India (ICAI) and a former governing council member of Banking Codes and Standards Board of India, nominated by RBI.

The company management reiterated its commitment to driving sustainable business growth while upholding regulatory and compliance standards.