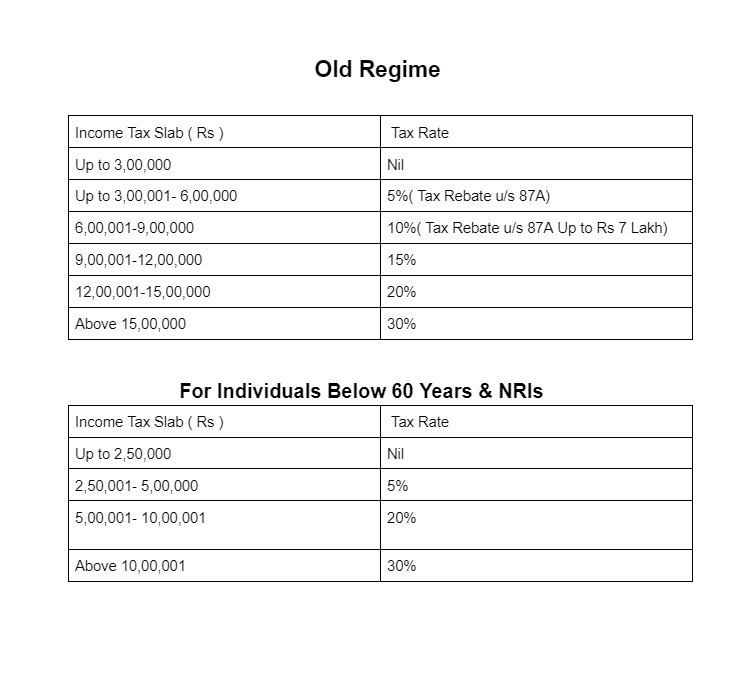

Finance Minister Nirmala Sitharaman has announced a major overhaul in the personal income tax rates under the new tax regime. The revised tax structure is designed to simplify tax calculations and provide greater relief to taxpayers. According to Sitharaman, the new rates will be as follows:

Key Updates in the New Tax Regime:

- Standard Deduction Increase: Salaried employees will benefit from an increase in the standard deduction under the new tax regime, rising from Rs 50,000 to Rs 75,000.

- Revised Tax Slabs:

- Income up to Rs 3 lakhs: No tax

- Income between Rs 3-7 lakhs: 5% tax

- Income between Rs 7-10 lakhs: 10% tax

- Income between Rs 10-12 lakhs: 15% tax

- Income between Rs 12-15 lakhs: 20% tax

- Income above Rs 15 lakhs: 30% tax

These adjustments aim to provide greater tax relief and streamline the tax process for individuals opting for the new tax regime.

Advertisement · Scroll to continue