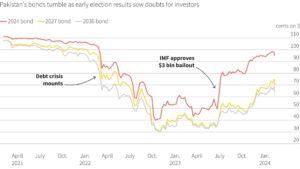

A new government in Pakistan is being negotiated, assuaging initial concerns about instability in the nuclear-armed country after last week’s inconclusive elections. However, there is still a chance of a full-blown economic crisis. Securing a new, much larger program from the International Monetary Fund (IMF) is widely regarded as the administration’s top priority, as the current $3 billion program expires next month.

With whom could the IMF engage in negotiations?

The Pakistan People’s Party (PPP), which is the second-largest party, endorsed the Pakistan Muslim League-Nawaz (PML-N) on Tuesday. The PPP is being convinced to join forces with the PML-N to form a majority coalition. Implementing the IMF loan program that was approved in July and helped prevent a sovereign debt default is the caretaker government that has been in office since August. Recent legislation gives it the authority to supervise elections and decide on economic issues pertaining to the South Asian nation. When contacted for comment on the likelihood of a new IMF agreement, it did not answer right away.

HOW DEPRIVATE IS THE ECONOMIC CONDITION?

Although it is an improvement from the $3.1 billion they were down to just over a year ago, Pakistan’s foreign exchange reserves currently stand at about $8 billion, which scarcely covers two months’ worth of necessities.

They will be further reduced by a $1 billion bond payment due in two months, even though the nation will also receive an infusion of $700 million in previously approved IMF funding.

“It is imperative (to get into another IMF programme), given that Pakistan’s foreign exchange reserves are abysmally low compared to its large impending external debt repayment needs. Former deputy central bank governor Murtaza Syed said. “There is no alternative”.

WHAT AMOUNT OF DEBT IS THERE?

Pakistan’s debt-to-GDP ratio is already over 70%, and this year’s interest payments on its debt are expected to account for between 50% and 60% of the country’s government revenue, according to estimates from the IMF and credit rating agencies. Of all the major economies in the world, that ratio is the worst. Tellimer, an analyst firm, claims that domestic debt, which makes up approximately 60% of the nation’s debt stock and 85% of its interest burden, is the main cause of the problem. Pakistan’s external debt stock is heavily weighted towards bilateral and multilateral creditors, making up approximately 85% of the total, and is primarily denominated in dollars.

Three percent of the nation’s total public debt and only 8% of the stock of external debt are bonded debt. This pales in comparison to the nearly 13% of total debt that Pakistan owes to China, which has given Pakistan loans over the years for various spending projects and infrastructure improvements.

WHAT IMPACT IS IT HAVING ON THE POPULATION?

The rupee’s sharp decline along with increases in taxes and gas prices have caused inflation to rise to almost 30% annually. Although economists predict that it will eventually decline, it is anticipated to remain significantly higher than the central bank’s 5-7% target for some time. More declines in the rupee are anticipated. For background, the latest IMF staff report’s implied exchange rate is 305 rupees to the dollar for this fiscal year and 331 per dollar for FY 24/25, which are, respectively, 8% and 15% weaker than the current rate.